How to choose the best EFTPOS solution for your business

Navigating the options of EFTPOS technology, costs and providers can be daunting as you try to find the best EFTPOS solution for your Aussie business. Choosing EFTPOS is a big decision for any small business owner, and finding the right solution is essential for good cash flow and taking secure, fast payments.

In this article, we provide a checklist of questions to consider when looking for the best EFTPOS solution, so that you can make an informed decision about what best suits your business needs.

Six things to consider when choosing the best EFTPOS provider for your small business

With all the EFTPOS providers in the Australian market, it can be overwhelming to understand all the available alternatives and which could lead to just going with your bank’s EFTPOS solution, even if that’s not the best option in market for you.

Think about EFTPOS like choosing a utility partner, like electricity: it’s critical for your business, and you need it to be continual and stable in nature – meaning you need reliability. You need an expert payments provider.

So what is the best approach when choosing a provider? Ask yourself the following questions:

- Am I getting the right guidance?

- What if I need help with my payment solution?

- Will I be secure, compliant and up to date with the latest regulations?

- What am I really paying for?

- How easy is the EFTPOS machine to set-up and use?

- Am I partnering with someone well established?

1. Am I getting the right guidance?

An EFTPOS solution is an ongoing utility for your business. It’s a combination of a reliable product, prompt service and accessible support; often for an extended period of time.

This makes good service the most paramount factor to choosing your provider. This includes getting all the right information to get started, an easy set-up and experts to answer your questions through the process.

It’s important to think about what this service looks like when there are issues too – does the provider you’re evaluating seem like they will offer prompt support and, when needed, equipment replacement? Do they seem like they value security and are compliant, keeping your payments safe?

2. What if I need help with my payment solution?

EFTPOS is something you want to set and forget and not have to worry about too often. But should you require support, the resolution should be accessible, quick and hassle free. Should you face an issue, you don’t want to wait on hold for long periods to get through to your payments provider for help, losing business or angering your customers in the process.

At Smartpay, this is one of the key pillars of our business: we believe in offering best-in-class support for our merchants. Smartpay offers 24/7 support, 365 days a year, with all our EFTPOS solutions. Our dedicated help desk with local EFTPOS experts is ready to help in any situation, including prompt machine replacements where technical issues can’t be resolved on the phone.

To learn more about our service promise, check out what we offer.

3. Will I be secure, compliant and up to date with the latest regulations?

EFTPOS machines handling your business transactions need to be kept secure with regular software updates that meet industry regulations. These should ideally be done remotely; with no disruption to your business. Any out-of-date hardware should also be replaced with a compliant machine. When evaluating a provider, it would be worthwhile to get a sense of whether they are the provider of your payments terminal, or a reseller.

Smartpay maintains our own EFTPOS machines, which includes releasing updates that are automatically downloaded by our terminals. Our in-house tech experts keep our terminals secure and also deliver product improvements and new features.

4. What am I really paying for?

EFTPOS costs should be easy to understand and transparent; with no hidden fees or charges. Your provider should clearly guide you on the costs involved to accept EFTPOS payments. It’s also important to understand what the terms of your contract are – how long are you signing onto with this provider, and what will all the associated costs be?

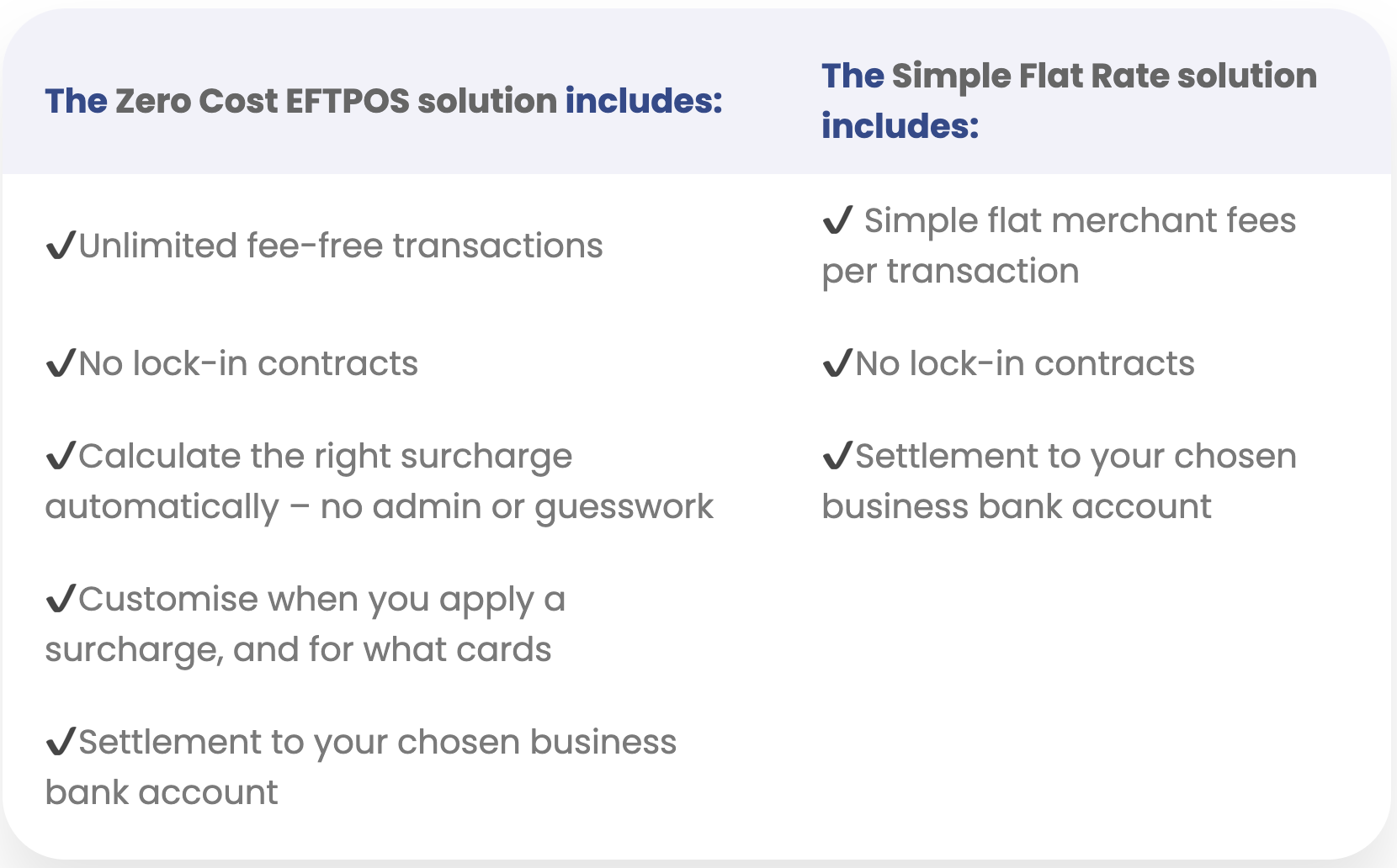

At Smartpay, we don’t do lock-in contracts, as we believe merchants should have the flexibility to choose the provider that’s right for them. As well, we offer the ability to avoid fees, with our Zero Cost EFTPOS. Or, we have a Simple Flat Rate option as well. You have flexibility to choose your EFTPOS setup depending on the requirements of your business and how you would like to accept payments from your customers.

Here are how these solutions compare:

With our transparent charges and next day settlement, you will always know what you’ll pay in merchant fees and you’ll get paid the next day into your chosen bank account.

5. How easy is the EFTPOS machine to set-up and use?

To make it easy for you and your staff to use day-to-day, the best EFTPOS machine is one that is intuitive, user friendly and versatile. This doesn’t just include taking payments but also to do simple tasks like process refunds and change paper rolls easily.

Smartpay EFTPOS terminals come ready to use out of the box. They are pre-configured and require no set-up or long wait times for installation. Everything you need to get started is included in the box along with the terminal. Our in-house experts are always available to answer any questions about using the EFTPOS machines and our website provides various resources for help and troubleshooting.

6. Am I partnering with someone who is well established?

From a merchant perspective, EFTPOS should be simple. But behind the scenes, there is effort and complexity involved in terms of technology and service.

Given you want to set-and-forget your EFTPOS solution, you ideally want to partner with a provider that you can rely on completely.

Consider a business that’s well established; with the scalability and bandwidth to provide country-wide support with minimal disruption. Meaning they need in-house capabilities to support their terminals, and to have a large team of locally based experts for technical assistance and account queries – so you are always assured that you are well taken care of in a situation where it matters most.

Talk to Smartpay today!

To empower you to make the best choice, a good EFTPOS provider should walk you through this information, learn more about your business and work with you to tailor the best EFTPOS solution.

At Smartpay, we pride ourselves on making the process of getting EFTPOS for your business easy and stress free. Our payment specialists have helped thousands of Aussie and Kiwi businesses get the best EFTPOS solution for them. Talk to us today about getting started with Smartpay.

Article by Smartpay

----------------------------------------------------------------------

Smartpay Cashback Offer to ABIC members:We are offering a guaranteed $250 cashback for ABIC members switching their EFTPOS facilities to Smartpay, and up to $1000 cashback depending on your monthly volume:

This offer is only applicable to new Smartpay customers who are ABIC members. View the offer and make the switch to Smartpay today!